working capital funding gap calculation

Average requirement 20000 45000-200002 32500 Finance cost 5 x 32500 1625. The companys working capital would equal 200000 or 500000 - 300000.

Change In Working Capital Video Tutorial W Excel Download

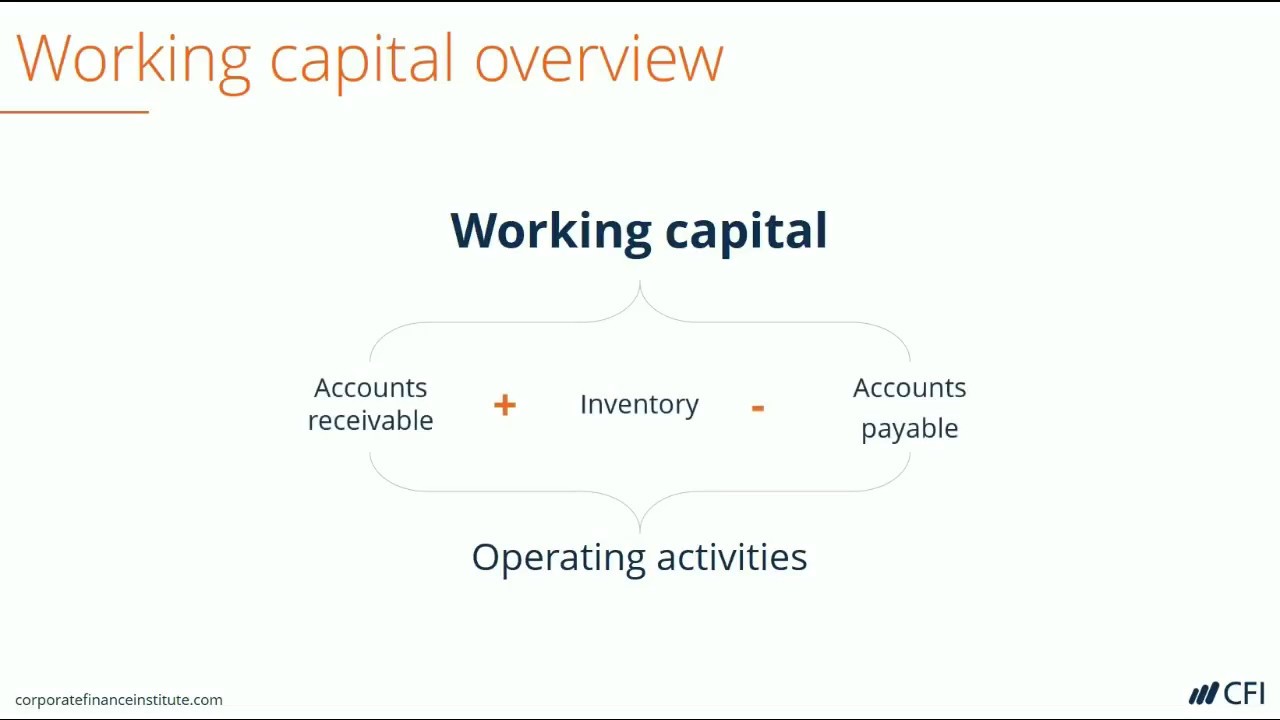

A working capital formula determines the financial health of the.

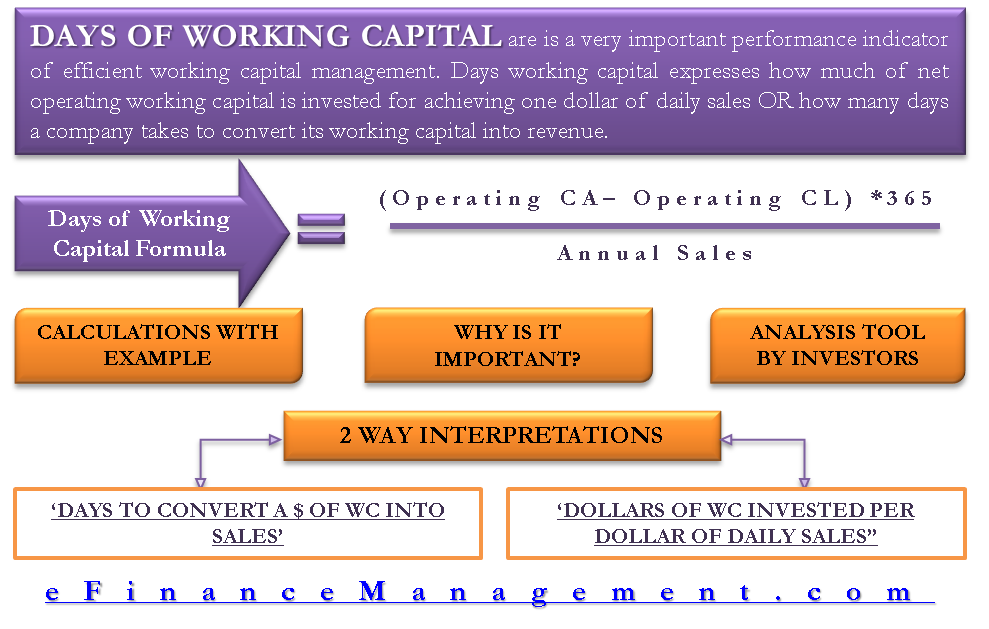

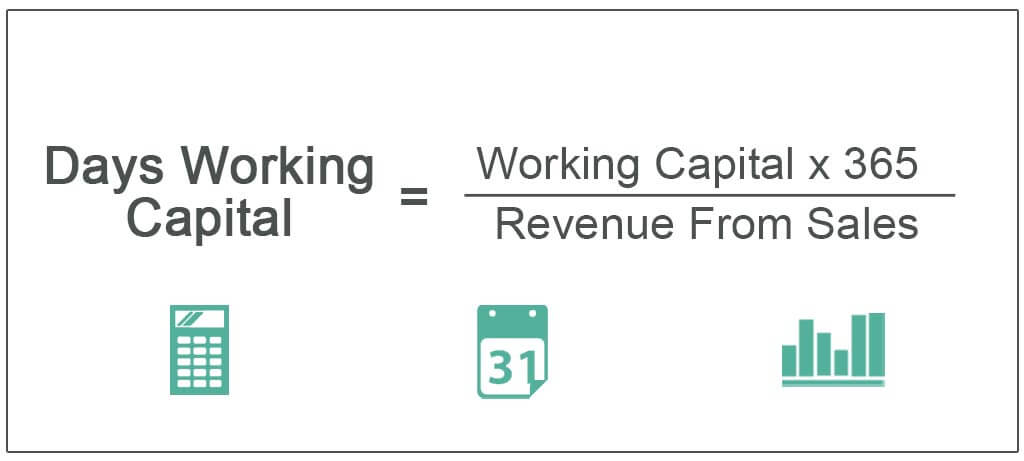

. The days working capital is calculated by 200000 or working capital x 365 10000000. If however the business chooses to use long term finance this flexibility is. 90 days 90 20k invested x 90 18k 38k paid back.

The working capital formula tells us the short-term liquid assets available after. Funding is what you have available to use in your business or in a very simple calculation you can say that working capital is the difference between all the current assets and all the current. However if the company made 12.

If your new venture experiences a need for short-term working capital during its first few years of operation you will have several potential sources of funding. It can also be described. 𝑟𝑓 𝑃1𝑇 In addition companies must also provide all the.

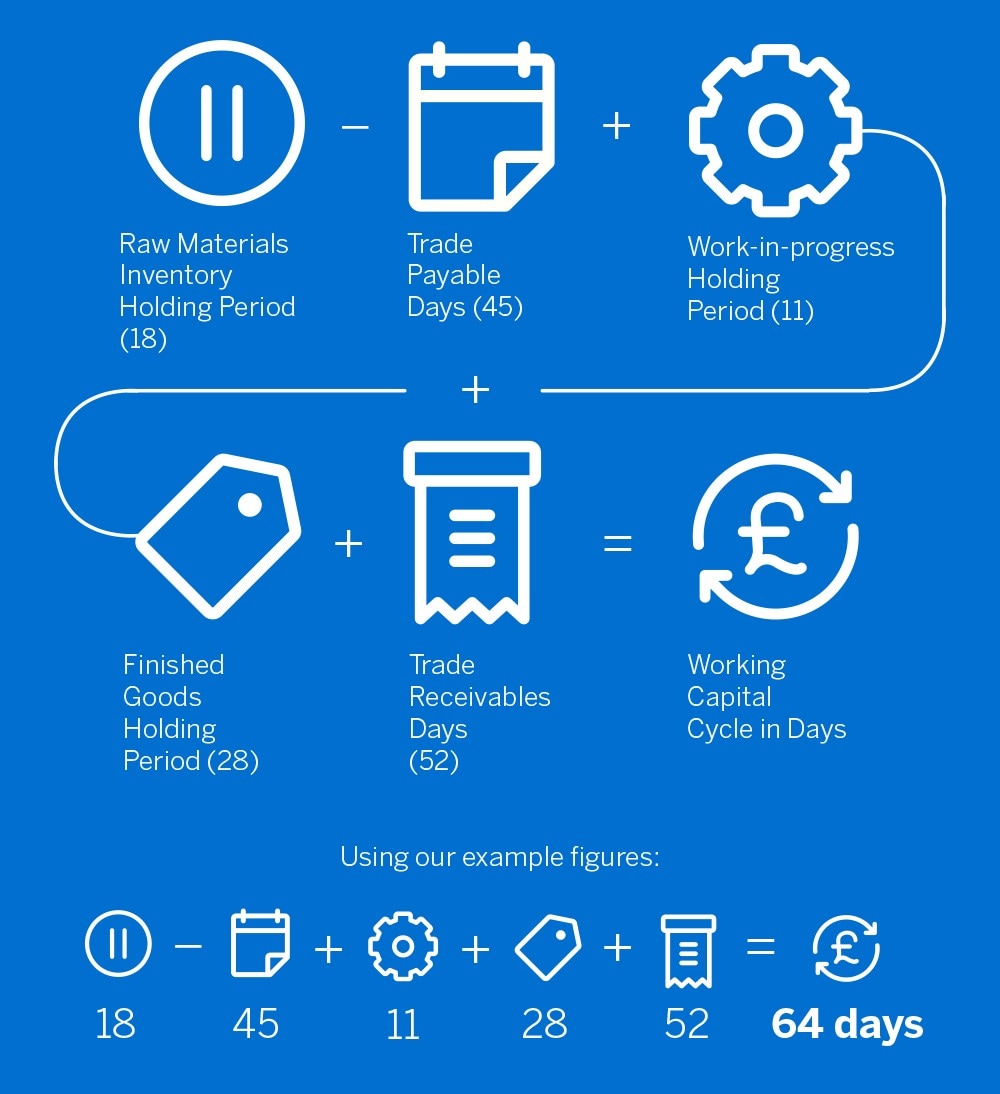

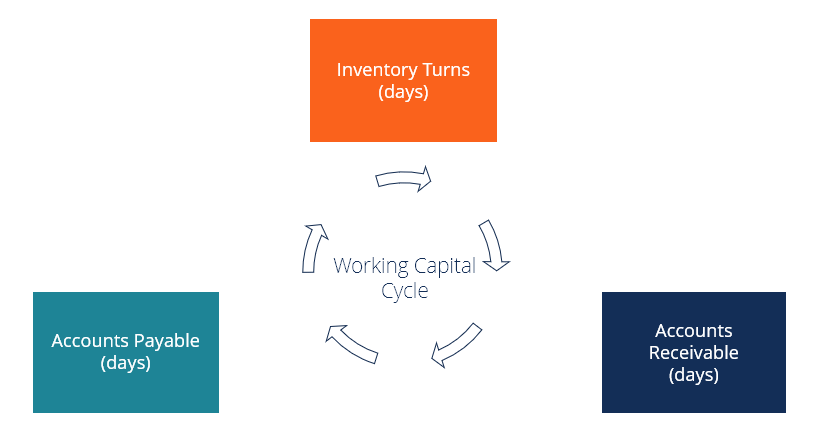

Working Capital Gap. Your current ratio will give you an idea if you have enough working. Working Capital Days Receivable Days Inventory Days Payable Days This ratio measures how efficiently a company is able to convert its working capital into revenue.

In plain terms the working capital deficit is the difference between total liquid assets and total equity other than bank liabilities. We need to calculate Working Capital using Formula ie. Working capital gap Current assets current liabilities other than bank borrowings For exampleCurrrent if current asset is 100 and current liabilities is 80bank.

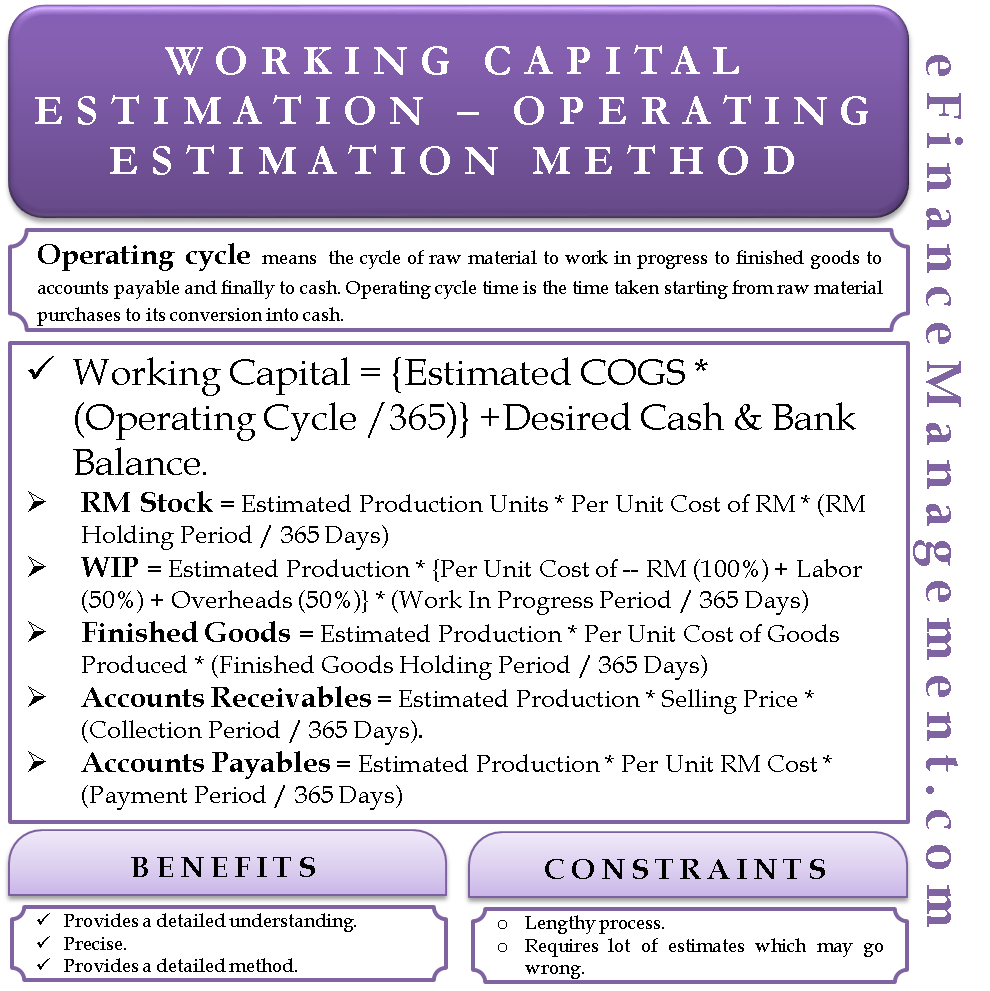

To calculate the working capital needs one needs to use the following formula. The working capital formula is. Here the working capital calculation considers.

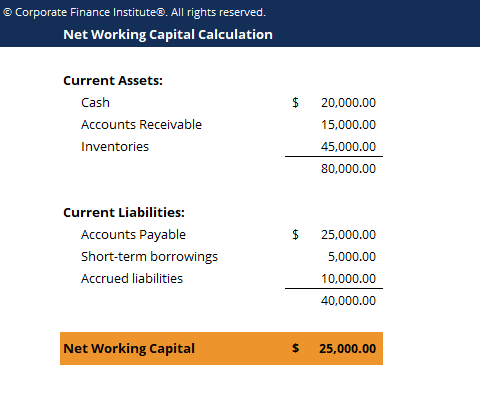

Whats the companys working capital funding gap in days based on the information below. Working Capital Current Assets Current Liabilities. Working Capital Current Assets Current Liabilities.

Net working Capital Current Assets Current Liabilities. The so called Working Capital ratio current ratio is calculated as current assets divided by current liabilities. The justification consists in demonstrating that the internal company WACC results from the following formula.

𝐴.

Working Capital Cycle What Is It With Calculation

Working Capital Cycle What Is It With Calculation

Working Capital What Is Working Capital Youtube

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)

How Do You Calculate Working Capital

Modelling Working Capital Adjustments In Excel Fm

Days Working Capital Formula Calculate Example Investor S Analysis

Working Capital Formula Youtube

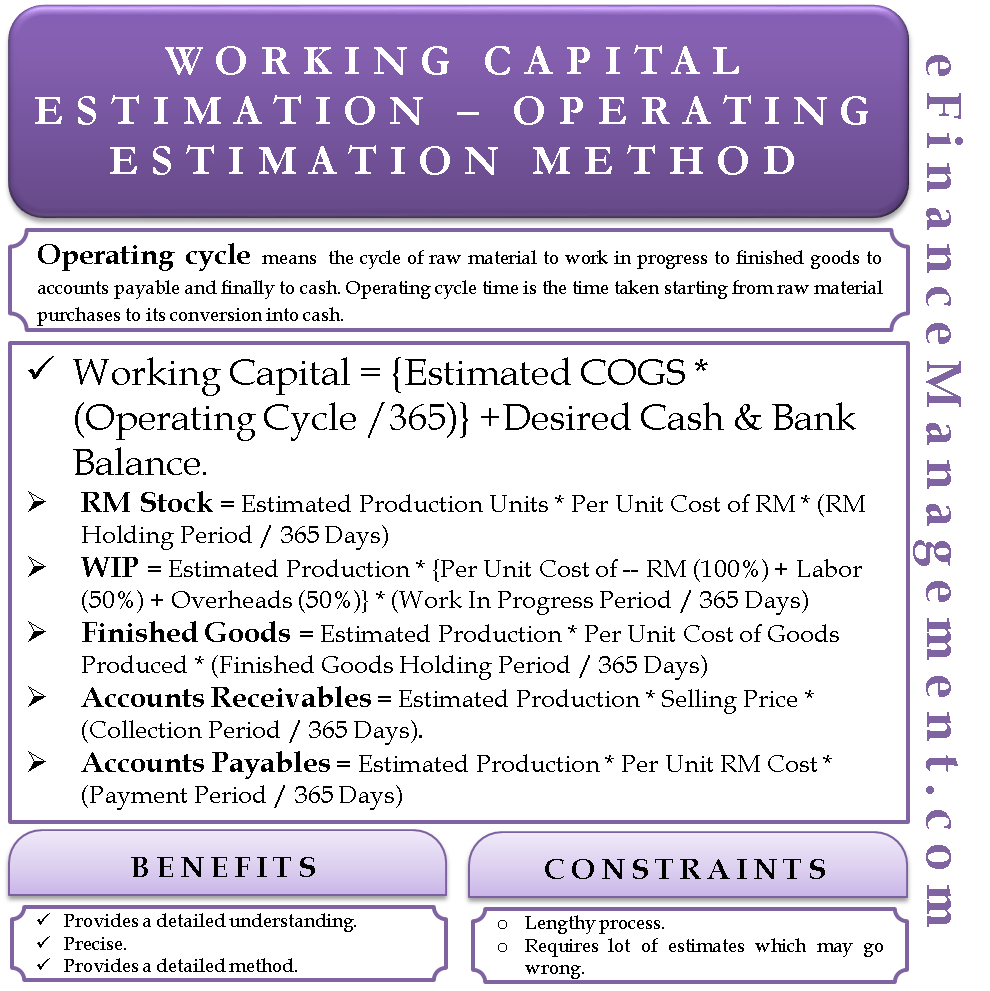

Working Capital Estimation Operating Cycle Method

Working Capital Cycle Definition How To Calculate

Working Capital Cycle Understanding The Working Capital Cycle

Net Working Capital Template Download Free Excel Template

Modelling Working Capital Adjustments In Excel Fm

Working Capital Cycle Efinancemanagement

Method For Estimating Working Capital Requirement Financial Life Hacks Accounting And Finance Learn Accounting

Working Capital Cycle Understanding The Working Capital Cycle

Working Capital Financial Edge Training

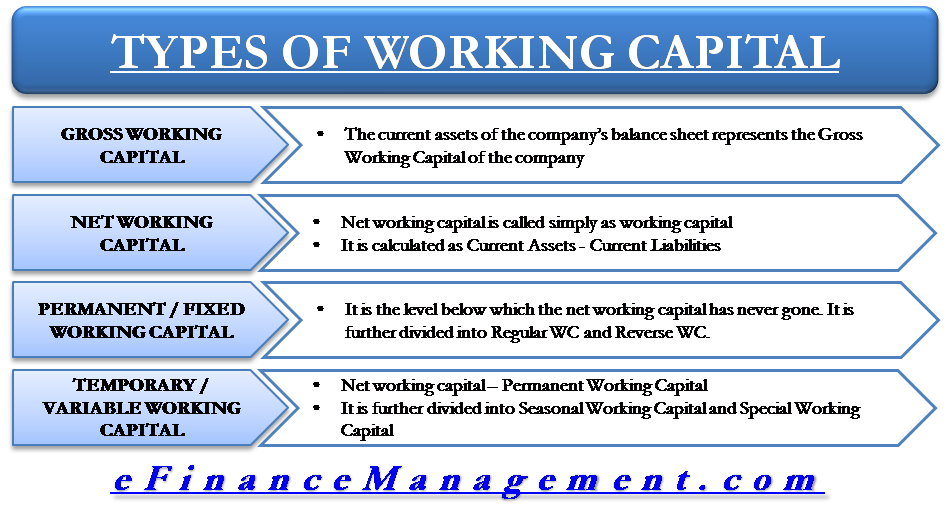

Types Of Working Capital Gross Net Temporary Permanent Efm

/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)